Transfer pricing support

What we do

We provide hands-on transfer pricing support to local and regional accounting, audit and tax advisory firms and their clients: Dutch based companies with operations outside the Netherlands and foreign companies with business operations in the Netherlands.

- TP model design and optimization

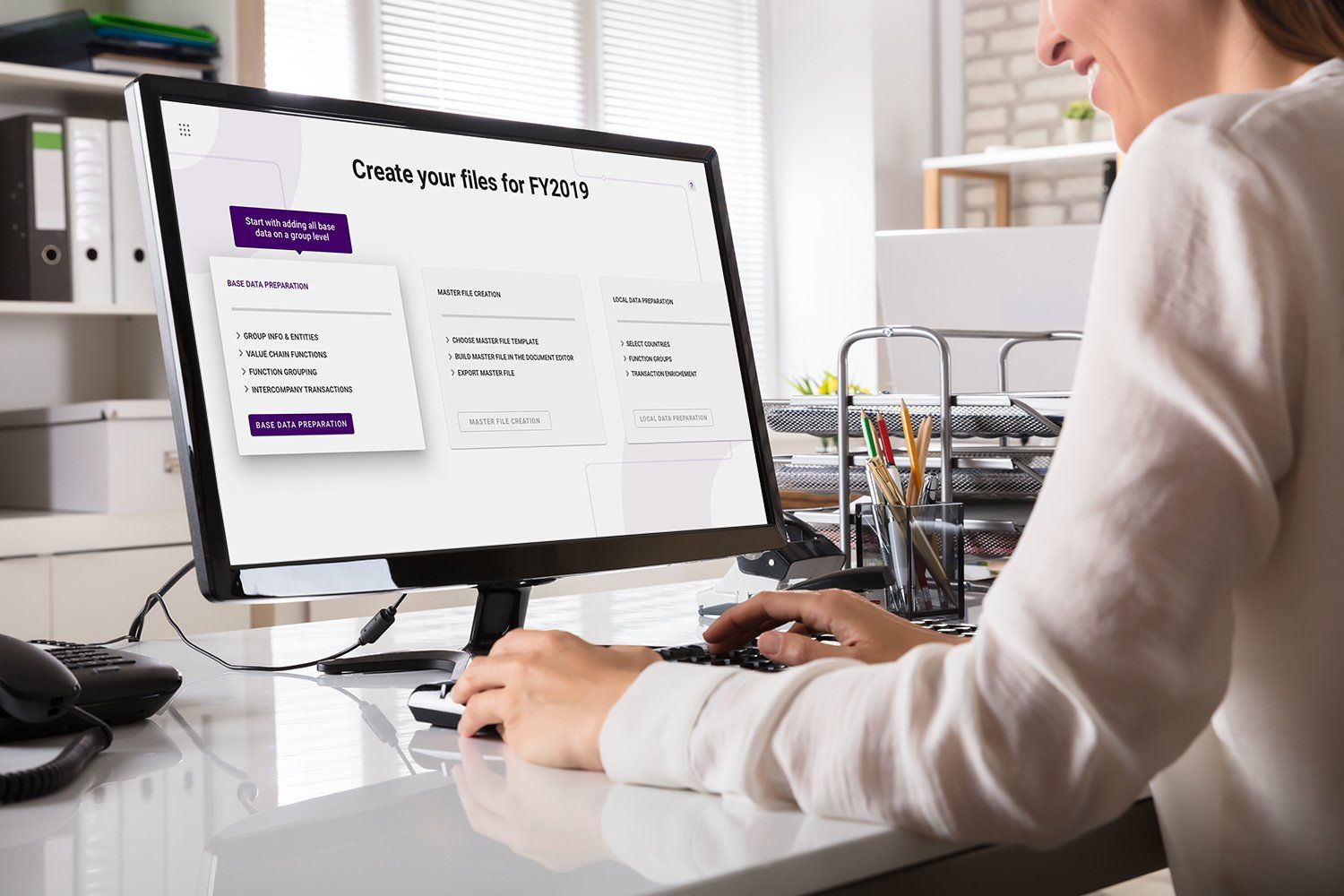

- TP documentation (masterfile and local files)

- Inter-company agreements

- Benchmarks

- TP accounting & reporting

- and more

Our clients

Our clients are mainly midsize to large companies with international operations that are big enough to have to comply with transfer pricing (documentation) requirements, but too small to have (in-house) transfer pricing expertise, or just need extra hands to get the transfer pricing work done.

How we work

Basis a thorough functional analysis of our client’s business operations, funding structure and legal structure, we help our clients to set up, update or adjust/streamline their transfer pricing model to reflect economic reality in line with OECD transfer pricing guidelines and local transfer pricing regulations.

The functional analysis not only provides a solid foundation for mandatory transfer pricing documentation, but usually provides a better view on potential (direct and indirect) tax risks related to the company's international business operations, trade and service flows and funding structure, so the client (and their tax advisers) can better manage and minimize their tax risks.